A lot has been said about Instagram in the past few weeks, especially after its surprise addition of a video feature that caused quite a stir, as well as a lot of excitement in the social media world. Given this renewed interest, we decided to take a look at what airlines have been up to on this social network, with a specific focus on how Instagram fits into the overall airline marketing model. We started by searching for airline brands that already had an established presence on either Facebook or Twitter.

The results were full of surprises and quite interesting to say the least. However, since this is the first time anyone has taken such an in depth look at airlines on this social network, we decided to let the numbers speak first before diving into further analysis.

What the numbers say

At the beginning of our journey, our expectations were limited since Instagram had only recently become available in a “web-format” — previously it had only been available on mobile. Although we had seen many great campaigns, we believed that this limitation may have caused a lower adoption rate by brands.

To make our search more efficient we began by looking at 150 airline brands that were already active on Facebook or Twitter, as we believed these would have a higher likelihood of being present on Instagram.

The early results were quite encouraging, since well over a third of these airlines (65 to be exact) had an active presence on Instragram. The number of abandoned or empty accounts was reassuringly low at just 15, which compared favourably against other social networks like Google Plus (see our analysis) and Pinterest (see our analysis).

This low number is partially explained by the mobile-only limitation mentioned earlier that prevented the “gold rush” effect that we have seen on other social networks where airlines would join only because of the novelty factor.

- The best performing airline in terms of overall number of followers was Southwest airlines with a whopping 58,700 fans against an industry average of 5,007.

- In terms of efficiency, i.e. the number of followers per image posted, the best performer was Philippine Airlines (PAL) with a whopping 402 followers per image against an industry average of just over 55.

- The most dedicated airline, the one with the highest number of images uploaded, was Air Asia with 646 vs. an industry average of 110.

Fake, Fan generated and Scam accounts

A slightly more worrying aspect was the high number of airline-name accounts that were not controlled by the airlines themselves. In almost 50% of the cases where we could not find an official Instagram account, we did find accounts that were either named directly after the airline or were using usernames generally employed by that brand on other social networks.

In the vast majority of cases these accounts were harmless, having been created by fans or being simple empty/private accounts created by individuals who liked that username. In other cases, however, the issue was more serious and there was a malicious intent.

Another common problem happened when fans created accounts before the brand could open an official one. This may seem harmless at first, but in cases like that of Aeromexico, it caused confusion in users as the fan created account (@aeromexico) had a far more logical and easy to remember username than the official one (aeromexico_com).

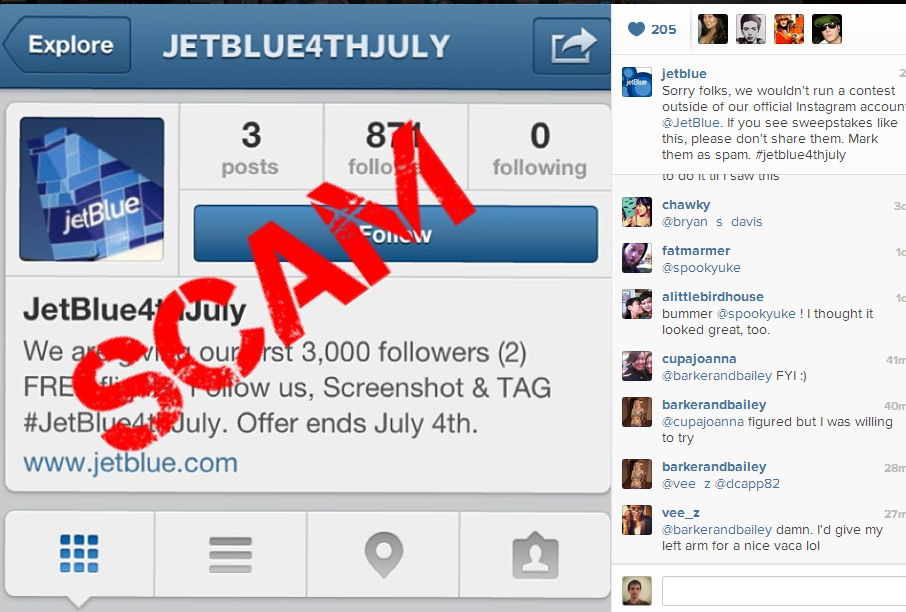

In some cases, airlines have acted proactively to stump out scam schemes like in the case of JetBlue that identified a fake account offering free flights and quickly acted to warn its followers.

The legacy surprise

One of the most surprising aspects of our research came from the most unexpected of places: legacy airlines. Being all too accustomed to see quick thinking low-cost airlines taking all the glory in the social arena, we were surprised to find a constant trend where socially active traditional airlines were getting much higher likes per image than their more “modern” colleagues.

After several checks, we found that airlines like Air France, British Airways, American Airlines and Delta all had one or more post with over 1000 likes and Qantas even reached 1,800 likes on a post showing its new uniforms. None of the low cost airlines, with the exception of Southwest Airlines, was able to achieve similar results.

Moreover, the trend did not appear to be limited to top-performing images. The likes per image average also appeared to be higher for these airlines than for any other traditional or low cost account.

Low cost reaction speed

In terms of reaction speed, however, low-cost airlines maintained their traditional record with Virgin America and JetBlue being the first two airlines to upload an Instagram video. Both of them uploaded videos on the very same day the new featured was announced and made available.

This may not sound as a great feat, however, we must remember that, though there were persistent rumous in tech circles, the Instagram announcement would have been largely viewed by airline brands with puzzlement regarding utility and a lack of preparation. Both of these airlines were able get the necessary Instagram app update, learn to use the new feature, plan a video and execute it, all within hours of the announcement.

In the next part…

On Thursday, we will take a closer look at what airlines are doing on Instagram in terms of their content and engagement strategies. Stay tuned! Click here for part 2