This article was first published on the CNBC blog

———-

Qantas announced today a net profit after tax of A$58 million for the first half of the financial year, down from $210 million a year earlier, although the airline did recover from a loss in the second-half of last financial year. This 72% dip in profits resulted in the shares falling by up to 7.2% in early morning trades. However, Alan Joyce, the CEO, says the carrier has done better than most of its rivals. And it has, indeed, thanks to its agility.

Agility through smart cost-cutting

Although revenues dipped by 13.4%, costs were slashed by 16.2%, which shows Qantas’ diligence and discipline in reducing expenditure in the past year. The cutting of frequencies to unpopular routes and grounding of older aircrafts was key to these cost savings.

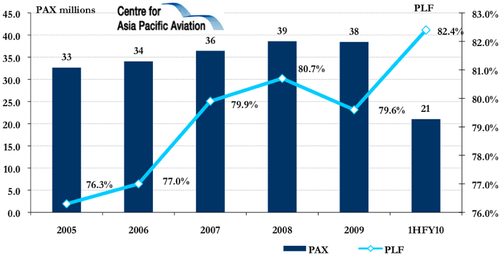

Load-factors have been the highest in five years – at 82.4%, on flights that carried a lesser number of total passengers as compared to the past year.

This simply means that flights were more full than in the past, despite the recession. Of course, the downside was that this was achieved by offering very low fares on certain routes, which are unsustainable in the long run. Alan Joyce eluded to this fact as well, by indicating that the industry’s survival depends on higher fares.

Agility in re-configuring the cabin

Qantas was one of the first airlines to add a Premium Economy cabin to their flights. Now, they’re standing by their decision by overhauling their cabins. Qantas will be removing First Class on most of its long-haul routes, with the exception of London and Los Angeles, and adding Premium Economy to their widebody jets.

This not just reflects the growing sentiment that Premium demand will change in the coming years, but also the fact that there are more First Class seats in the market than required. For example, from Sydney to London, a passenger has the choice to fly on First Class Suites on board Singapore Airlines, Emirates, Etihad, Qatar Airways and Qantas. Certainly a case of over-capacity.

Qantas is one of the first airlines in the world to remove the First Class in a systematic fashion, and change their long-haul plane configuration to Business, Premium Economy and Economy classes. This effectively increases the number of seats and hence reduces the cost per seat even further. Such agility will pay off for Qantas in the long term.

Leveraging on Jetstar

It’s a known fact that the two brand strategy, growing Jetstar aggressively, gives Qantas Group a very valuable option that few others can match. Jetstar’s profits tripled in the past year and continue to provide Qantas a very valuable asset to leverage on low-yielding routes. The two-brand strategy has also ensured that the Qantas Group doesn’t lag behind LCC competition from Virgin Blue and Tiger Airways.

Moreover, the recent Jetstar-AirAsia cost alliance should also help the airlines reap additional benefits in the near future through by tapping on each other’s scale and synergies.

In conclusion, even though profits have dipped, Qantas remains one of the most agile airline brands in the world and it’s this quick-thinking that will keep them ahead of most competition in the coming times. What do you think? Let’s discuss in the comments, and over on Twitter (@simpliFlying)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=4385ddfe-5b1a-4dbc-916f-08ece147128b)